This article is about retail vs institutional traders and the reasons why retail traders—who make up

95% of the market loses money, while institutional traders, only 5%, are the ones who

consistently make money.

This story begins in the late 1900s, when banks, institutions, and hedge funds like BlackRock and

Vanguard decided that in order to make more money, they needed to bring more people into the

market, so those people could lose money, and that money would flow to them. To achieve this,

they started writing half-baked and incomplete trading books and spread them across the world.

Once these books had circulated globally, the internet had reached the masses, and trading had

moved online, access to trade execution became extremely easy for the public.

People read these books and thought trading was very easy. Since trading could now be done from

home, thousands of people entered the market. Traders would win 1 out of 10 or 2 out of 10 trades,

which kept their desire to win alive but never allowed them to truly succeed—exactly like gambling.

From this era onward, gambling entered trading

After this, in the 2000s, when people failed to profit from trading, they began creating blogs and

YouTube videos related to trading. In this way, due to these failed traders, retail knowledge kept

spreading, and more and more people entered the market with half and incomplete knowledge,

continuing to suffer losses.

After that, the biggest trap spread by institutions and hedge funds was the idea that if you are not

profitable, it is not a technical issue but a psychological one. This was done so that unprofitable

traders would not focus on their incomplete skills and would instead blame psychology for their lack

of profitability. This is a trap designed to keep people from becoming profitable. Because if your

technical skills are weak, even the best psychology is useless. However, this does not mean

psychology has no importance in trading—psychology is important, but not to the exaggerated

extent it is portrayed.

“Either you sit at the chart with a plan, or you become part of someone else’s plan” — Shah of Forex

In the markets, this is not just a quote—it is a reality. Every candle, every move, and every breakout

rewards preparation and punishes impulse. Only those who enter the market with a clear trading

plan succeed, while those who enter the market without a trading plan become part of someone

else’s plan.

“The Chart Is an Illusion. Big Players Move Markets — and Their Moves Shape How You Feel,

Decide, and Act.” — Shah of Forex

The chart is not just price—it is perception. Behind every sharp move are powerful players shifting

liquidity, creating fear, urgency, and false confidence. These moves are designed to pull you in

emotionally, to make you chase, hesitate, or panic. When you understand that the chart shapes

your emotions as much as your decisions, you stop reacting to noise.

“Don’t get hypnotized by the illusion. Learn to read the strings, not the show.” — Shah of Forex

Don’t get hypnotized by the illusion. The market is a perfectly staged performance—lights flashing,

emotions running high, every move engineered to pull you in. Most people watch the show and

react. Few step back to study the strings controlling it. When you learn to see intent behind price,

structure behind chaos, and manipulation behind movement, the noise loses its power. This is the

moment you stop being entertained and start becoming dangerous in the market.

“A winning strategy is worthless without a winning mindset.” — Shah of Forex

Technicals are the blade of a trader—structure, levels, and precision create the real edge and

reveal where opportunity exists. But when price reaches that level and pressure rises, psychology

decides whether the trade is executed or destroyed. Fear causes hesitation, ego leads to

overtrading, and discipline is tested in seconds. Master the charts relentlessly, but develop your

mindset alongside them, because technicals show the path—and the mind decides who has the

strength to walk it.

“The game isn’t rigged. It’s designed — and you never read the rules.” — Shah of Forex

The market is not cheating you; it is exposing you. Every move follows a structure, liquidity, and

behavior that repeat daily for those who study them. Most traders lose not because the system is

unfair, but because they refuse to learn how it actually works. When you stop blaming the game

and start reading its rules, confusion turns into clarity—and survival turns into control.

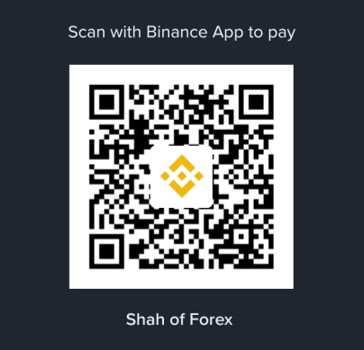

If you want to truly understand the rules, Shah of Forex is offering an exclusive 1-1 mentorship.

We will show you that trading is not gambling and not a rigged game. Instead, it operates according

to a clear set of rules—rules that are deliberately hidden from the public. Most people are taught

incorrect concepts so they unknowingly become liquidity for banks, hedge funds, and large

institutions

Now the real journey begins. This is not another signal group or shortcut fantasy. This is pure

market truth, explained one-on-one, without noise and without lies. Stop being hunted. Learn how

the hunters think. If you’re ready to step out of the crowd and trade like institutions—not against

them—this 1-1 mentorship is your gateway. Once you understand the rules, the market will never

look the same again.

We have very limited seats for the 1-1 mentorship, and for admission, you are required to pass an

interview called the Mentorship Alignment Call. This interview is not related to your trading skills;

instead, it focuses on your overall personality, mindset, and level of commitment.